Page 5 - Hawaii Top Flyers

P. 5

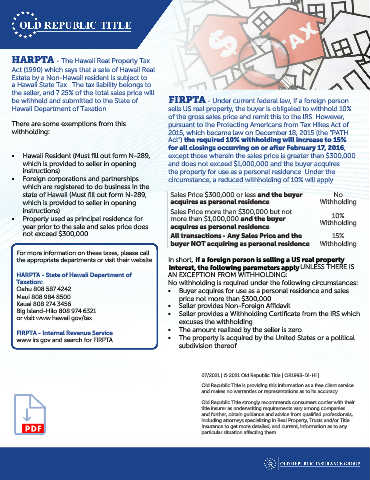

HARPTA - The Hawaii Real Property Tax

Act (1990) which says that a sale of Hawaii Real

Estate by a Non-Hawaii resident is subject to

a Hawaii State Tax. The tax liability belongs to

the seller, and 7.25% of the total sales price will

be withheld and submitted to the State of FIRPTA - Under current federal law, if a foreign person

Hawaii Department of Taxation. sells US real property, the buyer is obligated to withhold 10%

of the gross sales price and remit this to the lRS. However,

There are some exemptions from this pursuant to the Protecting Americans from Tax Hikes Act of

withholding: 2015, which became law on December 18, 2015 (the “PATH

Act”) the required 10% withholding will increase to 15%

for all closings occurring on or after February 17, 2016,

• Hawaii Resident (Must fill out form N-289, except those wherein the sales price is greater than $300,000

which is provided to seller in opening and does not exceed $1,000,000 and the buyer acquires

instructions) the property for use as a personal residence. Under the

• Foreign corporations and partnerships circumstance, a reduced withholding of 10% will apply.

which are registered to do business in the

state of Hawaii (Must fill out form N-289, Sales Price $300,000 or less and the buyer No

which is provided to seller in opening acquires as personal residence Withholding

instructions) Sales Price more than $300,000 but not

• Property used as principal residence for more than $1,000,000 and the buyer 10%

year prior to the sale and sales price does acquires as personal residence Withholding

not exceed $300,000 All transactions - Any Sales Price and the 15%

buyer NOT acquiring as personal residence Withholding

For more information on these taxes, please call

the appropriate departments or visit their website. In short, if a foreign person is selling a US real property

interest, the following parameters apply UNLESS THERE IS

HARPTA - State of Hawaii Department of AN EXCEPTION FROM WITHHOLDING:

Taxation: No withholding is required under the following circumstances:

Oahu 808.587.4242 • Buyer acquires for use as a personal residence and sales

Maui 808.984.8500 price not more than $300,000.

Kauai 808.274.3456 • Seller provides Non-Foreign Affidavit

Big Island-Hilo 808.974.6321 • Seller provides a Withholding Certificate from the IRS which

or visit www.hawaii.gov/tax

excuses the withholding

• The amount realized by the seller is zero

FIRPTA - Internal Revenue Service

www.irs.gov and search for FIRPTA • The property is acquired by the United States or a political

subdivision thereof

07/2021 | © 2021 Old Republic Title | OR1993-DI-HI |

Old Republic Title is providing this information as a free client service

and makes no warranties or representations as to its accuracy.

Old Republic Title strongly recommends consumers confer with their

title insurer as underwriting requirements vary among companies

and further, obtain guidance and advice from qualified professionals,

including attorneys specializing in Real Property, Trusts and/or Title

Insurance to get more detailed, and current, information as to any

particular situation affecting them.