Page 10 - Hawaii Top Flyers

P. 10

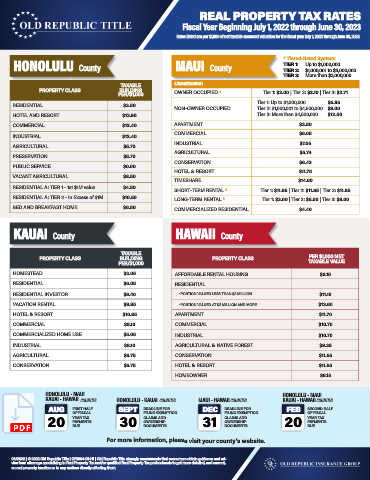

REAL PROPERTY TAX RATES

Fiscal Year Beginning July 1, 2022 through June 30, 2023

Rates listed are per $1,000 of net taxable assessed valuation for the fiscal year July 1, 2022 through June 30, 2023.

* Tiered-Rated System:

HONOLULU County MAUI County TIER 1: Up to $1,000,000

$1,000,001 to $3,000,000

TIER 2:

TIER 3: More than $3,000,000

TAXABLE Classification

PROPERTY CLASS BUILDING OWNER OCCUPIED * Tier 1: $2.00 | Tier 2: $2.10 | Tier 3: $2.71

PER/$1,000

Tier 1: Up to $1,000,000 $5.85

RESIDENTIAL $3.50

NON-OWNER OCCUPIED Tier 2: $1,000,001 to $4,500,000 $8.00

HOTEL AND RESORT $13.90 Tier 3: More than $4,500,000 $12.50

COMMERCIAL $12.40 APARTMENT $3.50

INDUSTRIAL $12.40 COMMERCIAL $6.05

AGRICULTURAL $5.70 INDUSTRIAL $7.05

AGRICULTURAL $5.74

PRESERVATION $5.70

CONSERVATION $6.43

PUBLIC SERVICE $0.00

HOTEL & RESORT $11.75

VACANT AGRICULTURAL $8.50

TIMESHARE $14.60

RESIDENTIAL A: TIER 1 - 1st $1M value $4.50

SHORT-TERM RENTAL * Tier 1: $11.85 | Tier 2: $11.85 | Tier 3: $11.85

RESIDENTIAL A: TIER 2 - In Excess of $1M $10.50 LONG-TERM RENTAL * Tier 1: $3.00 | Tier 2: $5.00 | Tier 3: $8.00

BED AND BREAKFAST HOME $6.50 COMMERCIALIZED RESIDENTIAL $4.40

KAUAI County HAWAII County

TAXABLE

PER $1,000 NET

PROPERTY CLASS BUILDING PROPERTY CLASS TAXABLE VALUE

PER/$1,000

HOMESTEAD $3.05 AFFORDABLE RENTAL HOUSING $6.15

RESIDENTIAL $6.05 RESIDENTIAL

RESIDENTIAL INVESTOR $9.40 *PORTION VALUED LESS THAN $2 MILLION $11.10

VACATION RENTAL $9.85 *PORTION VALUED AT $2 MILLION AND MORE $13.60

HOTEL & RESORT $10.85 APARTMENT $11.70

COMMERCIAL $8.10 COMMERCIAL $10.70

COMMERCIALIZED HOME USE $5.05 INDUSTRIAL $10.70

INDUSTRIAL $8.10 AGRICULTURAL & NATIVE FOREST $9.35

AGRICULTURAL $6.75 CONSERVATION $11.55

CONSERVATION $6.75 HOTEL & RESORT $11.55

HOMEOWNER $6.15

HONOLULU • MAUI HONOLULU • MAUI

KAUAI • HAWAII COUNTIES HONOLULU • KAUAI COUNTIES MAUI • HAWAII COUNTIES KAUAI • HAWAII COUNTIES

AUG FIRST HALF SEPT DEADLINE FOR DEC DEADLINE FOR FEB SECOND HALF

FILING EXEMPTION

OF FISCAL

FILING EXEMPTION

OF FISCAL

20 YEAR TAX 30 CLAIMS AND 31 CLAIMS AND 20 YEAR TAX

PAYMENTS

PAYMENTS

OWNERSHIP

OWNERSHIP

DUE.

DOCUMENTS.

DOCUMENTS.

DUE.

For more information, please visit your county’s website.

06/2022 | © 2022 Old Republic Title | OR1964-DI-HI | Old Republic Title strongly recommends that consumers obtain guidance and ad-

vice from attorneys specializing in Real Property Tax and/or qualified Real Property Tax professionals to get more detailed, and current,

on real property taxation as to any matters directly affecting them.