Page 20 - California Home Sellers Handbook

P. 20

08 FIRPTA

What is FIRPTA?

Under current federal law, if a foreign person sells US real property, the buyer is

obligated to withhold 10% of the gross sales price and remit this to the lRS.

However, pursuant to the Protecting Americans from Tax Hikes Act of 2015, which

became law on December 18, 2015 (the “PATH Act”) the required 10% withholding

will increase to 15% for all closings occurring on or after February 17, 2016,

except those wherein the sales price is greater than $300,000 and does not exceed

$1,000,000 and the buyer acquires the property for use as a personal residence.

Under the circumstance, a reduced withholding of 10% will apply.

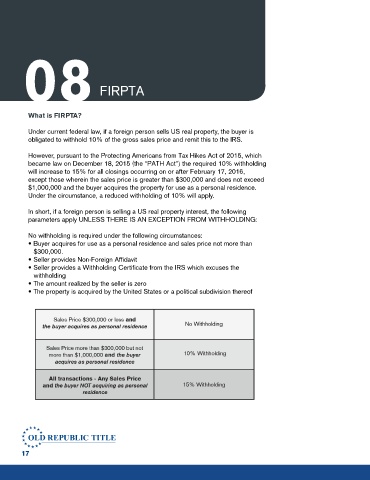

In short, if a foreign person is selling a US real property interest, the following

parameters apply UNLESS THERE IS AN EXCEPTION FROM WITHHOLDING:

No withholding is required under the following circumstances:

• Buyer acquires for use as a personal residence and sales price not more than

$300,000.

• Seller provides Non-Foreign Affidavit

• Seller provides a Withholding Certificate from the IRS which excuses the

withholding

• The amount realized by the seller is zero

• The property is acquired by the United States or a political subdivision thereof

17