Page 20 - California Home Buyers Handbook

P. 20

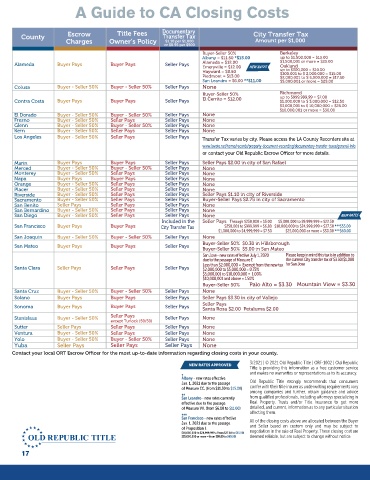

A Guide to CA Closing Costs

County Escrow Title Fees Documentary City Transfer Tax

Transfer Tax

Charges Owner’s Policy $1.10 per $1,000 Amount per $1,000

or $0.55 per $500

Buyer-Seller 50% Berkeley

Albany = $11.50 *$15.00 up to $1,500,000 = $15.00

Alameda Buyer Pays Buyer Pays Seller Pays Alameda = $12.00 $1,500,001 or more = $25.00

Oakland

Emeryville = $12.00

Hayward = $8.50 up to $300,000 = $10.00

$300,001 to $ 2,000,000 = $15.00

Piedmont = $13.00 $2,000,001 to $ 5,000,000 = $17.50

San Leandro = $6.00 **$11.00 $5,000,001 or more = $25.00

Colusa Buyer - Seller 50% Buyer - Seller 50% Seller Pays None

Richmond

Buyer-Seller 50% up to $999,999.99 = $7.00

Contra Costa Buyer Pays Buyer Pays Seller Pays El Cerrito = $12.00 $1,000,000 to $ 3,000,000 = $12.50

$3,000,001 to $ 10,000,000 = $25.00

$10,000,001 or more = $30.00

El Dorado Buyer - Seller 50% Buyer - Seller 50% Seller Pays None

Fresno Buyer - Seller 50% Seller Pays Seller Pays None

Glenn Buyer - Seller 50% Buyer - Seller 50% Seller Pays None

Kern Buyer - Seller 50% Seller Pays Seller Pays None

Los Angeles Buyer - Seller 50% Seller Pays Seller Pays Transfer Tax varies by city. Please access the LA County Recorders site at

www.lavote.net/home/records/property-document-recording/documentary-transfer-taxes/general-info

or contact your Old Republic Escrow O cer for more details.

Marin Buyer Pays Buyer Pays Seller Pays Seller Pays $2.00 in city of San Rafael

Merced Buyer - Seller 50% Buyer - Seller 50% Seller Pays None

Monterey Buyer - Seller 50% Seller Pays Seller Pays None

Napa Buyer Pays Buyer Pays Seller Pays None

Orange Buyer - Seller 50% Seller Pays Seller Pays None

Placer Buyer - Seller 50% Seller Pays Seller Pays None

Riverside Buyer - Seller 50% Seller Pays Seller Pays Seller Pays $1.10 in city of Riverside

Sacramento Buyer - Seller 50% Seller Pays Seller Pays Buyer-Seller Pays $2.75 in city of Sacramento

San Benito Seller Pays Seller Pays Seller Pays None

San Bernardino Buyer - Seller 50% Seller Pays Seller Pays None

San Diego Buyer - Seller 50% Seller Pays Seller Pays None

Included in the Seller Pays Through $250,000 = $5.00 $5,000,000 to $9,999,999 = $22.50

San Francisco Buyer Pays Buyer Pays City Transfer Tax $250,001 to $999,999 = $6.80 $10,000,000 to $24,999,999 = $27.50 ***$55.00

$1,000,000 to $4,999,999 = $7.50 $25,000,000 or more = $30.00***$60.00

San Joaquin Buyer - Seller 50% Buyer - Seller 50% Seller Pays None

Buyer-Seller 50% $0.30 in Hillsborough

San Mateo Buyer Pays Buyer Pays Seller Pays

Buyer-Seller 50% $5.00 in San Mateo

San Jose - new rates e ective July 1, 2020 Please keep in mind this tax is in addition to

due to the passage of Measure E the current City transfer tax of $3.30/$1,000

Less than $2,000,000 = Exempt from the new tax for San Jose

Santa Clara Seller Pays Seller Pays Seller Pays $2,000,000 to $5,000,000 = 0.75%

$5,000,001 to $10,000,000 = 1.00%

$10,000,001 and above = 1.50%

Buyer-Seller 50% Palo Alto = $3.30 Mountain View = $3.30

Santa Cruz Buyer - Seller 50% Buyer - Seller 50% Seller Pays None

Solano Buyer Pays Buyer Pays Seller Pays Seller Pays $3.30 in city of Vallejo

Seller Pays

Sonoma Buyer Pays Buyer Pays Seller Pays Santa Rosa $2.00 Petaluma $2.00

Stanislaus Buyer - Seller 50% Seller Pays Seller Pays None

except Turlock (50/50)

Sutter Seller Pays Seller Pays Seller Pays None

Ventura Buyer - Seller 50% Seller Pays Seller Pays None

Yolo Buyer - Seller 50% Buyer - Seller 50% Seller Pays None

Yuba Seller Pays Seller Pays Seller Pays None

Contact your local ORT Escrow O cer for the most up-to-date information regarding closing costs in your county.

3/2021 | © 2021 Old Republic Title | ORF-1002 | Old Republic

NEW RATES APPROVED

Title is providing this information as a free customer service

and makes no warranties or representations as to its accuracy.

*

Albany - new rates effective

Jan. 1, 2021 due to the passage Old Republic Title strongly recommends that consumers

of Measure CC. (from $11.50 to $15.00) confer with their title insurer as underwriting requirements vary

among companies and further, obtain guidance and advice

** from qualified professionals, including attorneys specializing in

San Leandro - new rates currently

effective due to the passage Real Property, Trusts and/or Title Insurance to get more

of Measure VV. (from $6.00 to $11.00) detailed, and current, information as to any particular situation

affecting them.

***

San Francisco - new rates effective

Jan. 1, 2021 due to the passage All of the closing costs above are allocated between the Buyer

and Seller based on custom only and may be subject to

of Proposition I.

$10,000,000 to $24,999,999 = (from $27.50 to $55.00) negotiation in the sale of Real Property. These closing cost are

$25,000,000 or more = (from $30.00 to $60.00) deemed reliable, but are subject to change without notice.

17